Designing and launching a Scandinavian digital-only bank

With a six-month launch deadline, is it possible to identify and develop a new business that would to enable a staid 200-year-old Financial Services Group to take an industry-leading position as a forward-leaning, innovative company?

| The challenge |

"Den råeste appen i verden!" - the coolest app in the world! This financial services (FS) company certainly had the trust of the market - but its heritage also painted them as a brand without the ability to keep pace with the needs of a fast-moving, highly networked new consumer. Is the coolest app in the world the answer - or can we uncover an unmet need so compelling, that it breaks free of a homogenous banking & FS market? |

| Insights & mind shifts |

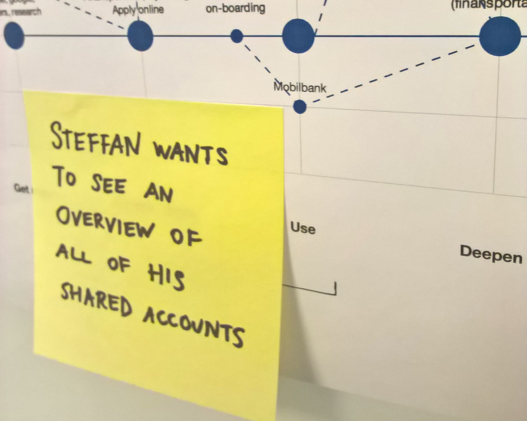

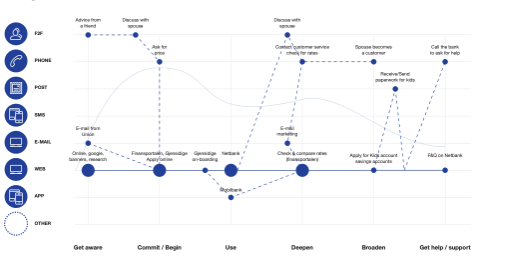

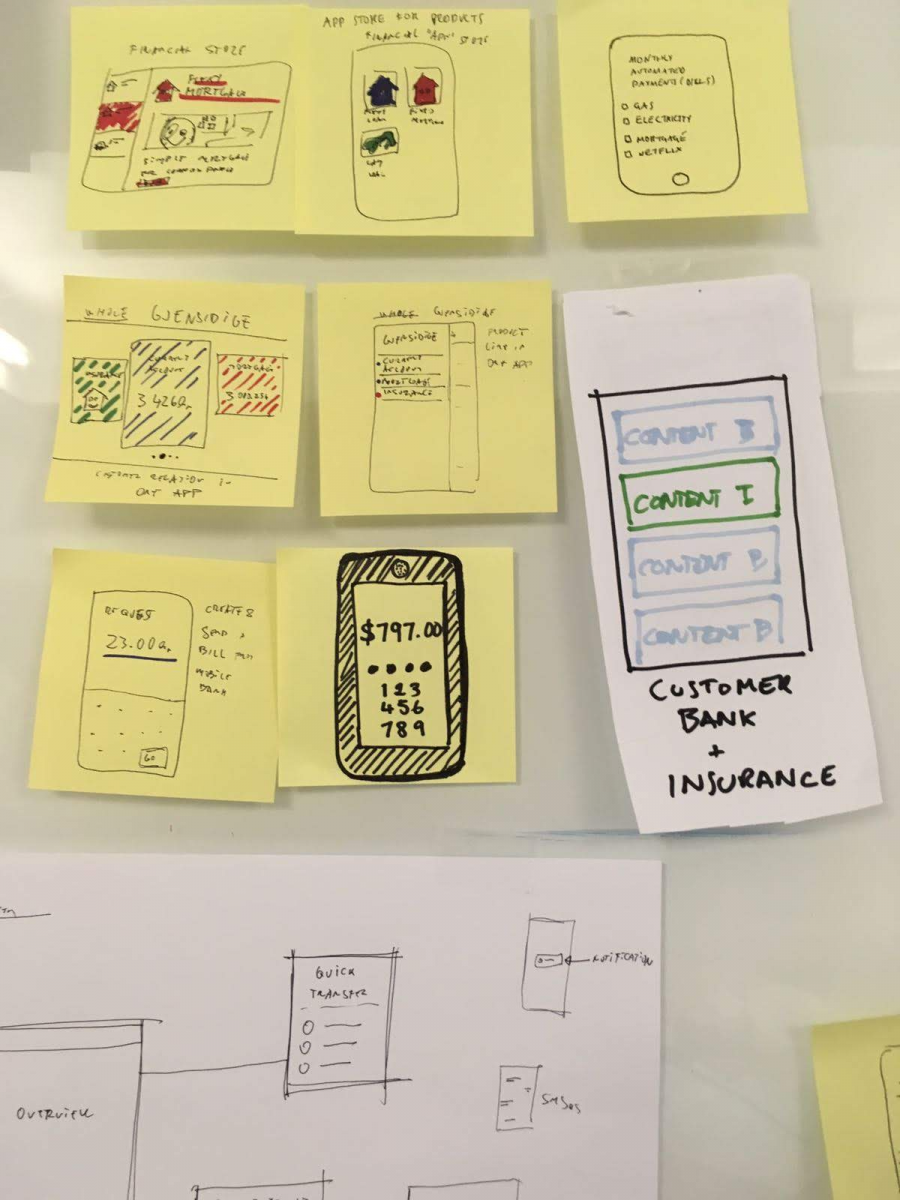

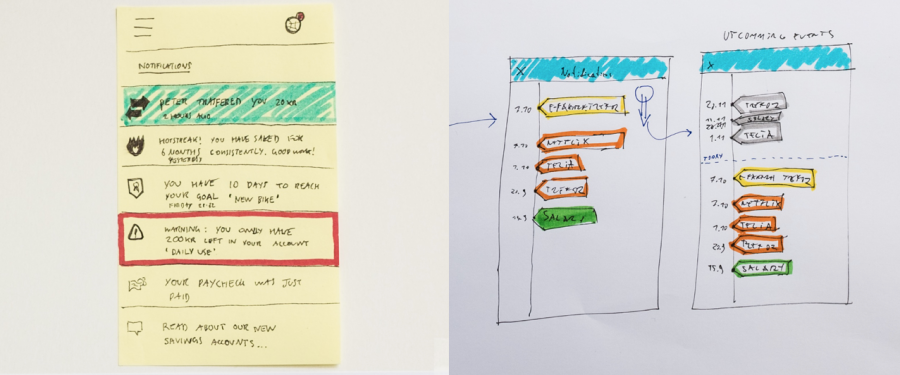

🕵️♀️ Your customers aren't who you think they are. Company data painted a picture of a reliable customer: a middle-aged native citizen, most likely male, with a solid grasp on a pretty contented state of affairs. And we heard most other financial services companies had pinned their futures on a similar profile. Here comes the curveball. Combined field and quant research revealed an entirely different picture; a much younger customer, or newly minted immigrant, hustling to make something happen - but without much buffer... and a lot of loyalty for someone supporting their big goals. 😫 There's no retail bank that helps me to... Ding ding - an unmet need. We heard from customers "We don't care about the name of the bank - we just want to make it to the end of the month with savings intact, and on the right track to bigger things". Money is a means to an end - they don't need another 'cool' app; but they do need help in making sure their day-to-day activities line up with their long-term plans. Current banks were stuck in providing a set of services defined by their competitors - but ill-fitting for the needs of the market; so of all the financial services, retail banking was to be the most ripe for disruption. ☕ Know me personally - but I don't want to visit a branch. In this market, an assumed value proposition was having a local branch. But research and testing prototypes revealed customers just wanted to feel seen and heard - and they didn't need a branch for that. So - potentially the new business could be online-only? So... adding all that up. Can we design and launch an online-only retail bank? |

| Results |

⏩ Fast-tracked launch for a new digital-only Mobile Bank: from research to prototype and product strategy, we developed this new venture in four months. The development was fast-tracked with the first releases beginning soon after. But it wasn't all plain sailing... 🤹♀️Building a new team and sprint-based implementation: a customer-centric and digitally-driven mindset was a huge adjustment for this company. To keep pace with a new style of product development, the company had to adjust. My team embedded to help the company train and hire the right skillsets to deliver digital products at speed. 🎳 A catalyst for transformation. This venture was used as a pilot, with learnings helping to build the strategy for a wider company transformation. |