Theiah insights

Resilience > Regulatory compliance

“Today, some of the world’s biggest businesses are calling for better – and more aggressive – government policy to tackle the biggest global challenges.”

Matthew Gittsham, The Guardian (1)

It often takes an immediate and visible threat to force change. Incoming environmental or social impact regulation is often the trigger for businesses to take action, however, waiting until you’re forced to change is not only a risky move - businesses focusing solely on ‘compliance’ are missing a huge opportunity.

Top CEO’s are well aware of the business case for regulation - that’s why many are aggressively demanding more. In a “Business Manifesto” presented at the World Economic Forum in Davos, for example, chief executives from top companies like KPMG, Philips, Yara, GSK, AkzoNobel, Unilever, and others called for government leaders to be as ambitious as possible in making policy deals at upcoming Sustainable Development Goals and climate summits. (16)

In this article, we’ll take a deeper look at the types of regulation, cover the business case and find out why many companies are SUPER KEEN for regulation and finally share some tips on how to anticipate what might affect your industry

What types of regulation create change?

Governments can influence the behaviour of companies by either incentivising good behaviour and penalising harm. But government policy is not the only force of coercion; there are also voluntary policies and industry standards that create change through market pressure.

To avoid risk and to remain competitive in your market, it is critical to be aware of both mandatory and voluntary ‘regulatory’ forces companies:

- Government policy and regulation: direct, usually enforced by either fines, taxes or incentive programs.

- Industry standards: indirectly enforced as non-compliant businesses lose credibility

- Charters, Commitments and conventions: voluntary agreements, alliances and declarations

The business case for regulation, and why many companies DEMAND it

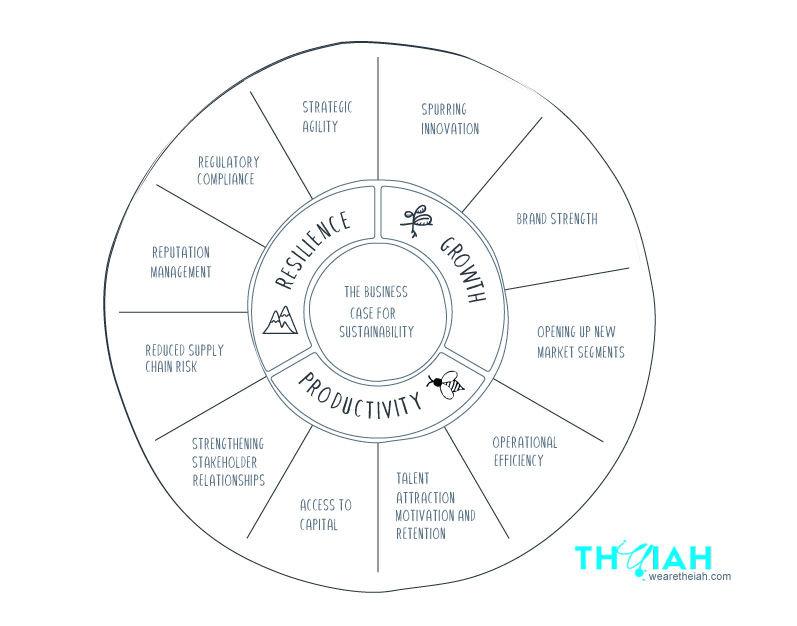

Far from being feared, social and environmental regulations can actually increase the competitiveness of a firm and are often viewed as drivers of economic growth.

No alt text provided for this image

For example, the famous Porter hypothesis (2) argues that more stringent environmental policies can actually have a net positive effect on business by promoting cost-cutting efficiency improvements, which in turn reduce or completely offset regulatory costs, and foster innovation in new technologies and green products that can help firms achieve international leadership and expand market share.

There is now a growing trend of some CEOs actively lobbying for more ambitious government action and regulation on a whole range of social and environmental issues (3), and the reasons are numerous:

Direct financial impacts:

- Most obviously, businesses that are compliant with direct government regulations avoid direct costs, through fines or taxes

- Incentives are often offered by governments for behaviour changes that positively impact the environment or society

Resilience-promoting impacts

Regulation can make it more financially viable to meet market demand and address society’s challenges. Studies and anecdotes abound - social and environmental regulation should increase company profits - in the right balance and if the company takes the opportunity. (4)

- Recently, more ambitious corporate action and sustainable innovation has been driven by increased pressure and higher expectations from the rest of society that business should play a role in helping sort out contemporary global challenges. (5)

- CEOs are finding it tough to meet these expectations and through internal innovation and voluntary actions alone. The scale of today’s social and environmental challenges requires government action and industry coordination, too — there are some ways in which public policy can drive change that cannot be achieved otherwise. (6)

- It is also crucial to point out regulation is designed to promote ethical behaviour, crucial to sustaining economies, societies, and your own industry. For any company with good intentions, regulation should be good news, preventing companies from gaining an unfair advantage by acting unethically. (7)

Innovation is the product of pressure and hard times. Regulation can create that pressure. The link between environmental or social regulation and innovation is well proven - opportunities are particularly rich in technological innovation. (11)

- One study by UK organisation Nesta found confirmed Porter’s Hypothesis, some social regulations led even to the development of completely new markets. This is more likely the case when regulations are more stringent and disruptive in order to achieve challenging societal or environmental objectives because then they tend to promote more radical innovation. (12)

- For many companies, the right solutions are already available for tackling social and environmental challenges, but they don’t become commercially viable unless regulatory change aligns commercial incentives with the right thing to do. (13)

- Interestingly, economic regulation does not produce the same effect on innovation as environmental or social regulation (neutral or negative).

Regulation can also lower costs - often indirectly but significantly. This benefit can be difficult to measure, and often involves externalities - and because of this, this advantage is often overlooked. In a wider economic example from the USA, benefits of the 1970 Clean Air Act exceed costs by a factor of 30 to 1. The 1990 Clean Air Act Amendments match that ratio: $1 of investments led to $30 in benefits — due to fewer children sick or dying, more productive workers, and healthier environs.

Regulation can create internal alignment and trigger co-ordinated action. While the benefits of pursuing a sustainable agenda might be very clear to one department, it can be hard to get the rest of the business to take notice. The threat of legal action, or taxation, directly impacting the bottom line, can push companies to make necessary changes more quickly.

Compliance protects future earnings by avoiding reputation damage. When companies are not compliant, either with mandatory regulation or the common standard of the industry, they stand to take a huge financial hit when this is exposed. And as transparency is only increasing, it is very difficult to hide.

- Reputation-linked losses at public companies have increased by 301 percent over the past five years, according to a study by Steel City Re. (8)

- In 2018 the number of incidents increased 25% percent over the previous year. (9)

- Reputation insurance research shows “reputational crisis will shave an average 7% from a company’s market capitalization. (10)

- For more on this one, see our previous article!

How can we figure out what regulations are coming (and where do they come from)?

Regulation usually emerges from international agreements or commitments. While international commitments are not enforceable on their own, they usually spur internal policymakers and industry bodies to design a framework of regulations that would help to achieve the international commitments.

- Keeps tabs on news coverage of international and industry agreements on environment and human rights so see the likely direction of regulation. Also, look out for negative press on companies who’ve acted badly in these areas - regulation often follows a scandal.

- Some typical commitments to look out for, for example, are towards carbon neutrality and emissions, climate change, circularity, zero waste, diversity and inclusion, fair trade and ethical production, local-made and ethical/ESG investment. Each industry will have a slightly different focus area.

- Groups of countries tend to move together; look to Europe to see the likely direction of policy. If you’re already in Europe countries like Denmark, Switzerland, Austria, Finland, Sweden, and Norway are often first movers for ethical company behaviour.

- But the best way to stay on top of change is to create it; get involved with policy advocacy in your industry. Use your experience, voice, and influence to inform and support governments to decide public policy. Aim for public policy outcomes that both effectively address environmental societal challenges, and enable long-run economic value creation - not just individually but in the long term and for society. The greatest chance for your own resilience is if the world and market around you is also thriving.

What can we expect going forward?

It seems likely regulation will increase. Historically, government intervention increases following a crisis. Governments during the pandemic have imposed wide-ranging public health measures, enacted new regulatory responses and provided massive stimulus, all in a manner without parallel since the Second World War. Many are planning for increased regulation in the coming years. (15)

In addition, policymakers are recognizing the critical role that the global financial system can play in sustainability and are holding investors accountable. This will naturally increase pressure on companies for both regulatory compliance and disclosure.

By viewing this as an opportunity, staying ahead of regulation, and getting involved in the policy-making themselves, companies can find huge benefits to the bottom line, and for long-term resilience.

Feike Sijbesma of DSM explains,

“As a business leader, you cannot be successful, nor even call yourself successful, in a society that fails.”

References:

- https://www.theguardian.com/sustainable-business/series/values-business

- Porter and van der Linde, 1995 https://www.aeaweb.org/articles?id=10.1257/jep.9.4.97

- https://www.coworkingconsulting.com/2018/10/19/why-climate-change-and-other-global-problems-are-pushing-some-business-leaders-to-embrace-regulation/

- https://www.sciencedaily.com/releases/2016/08/160812073700.htm

- https://hbr.org/2018/10/why-climate-change-and-other-global-problems-are-pushing-some-business-leaders-to-embrace-regulation.

- What Determines Ethical Behavior in Public Organizations: Is It Rules or Leadership? - Downe - 2016 - Public Administration Review - Wiley Online Library

- https://www.forbes.com/sites/forbestechcouncil/2018/08/09/why-innovation-and-regulation-should-work-together/?sh=6eedc0129411

- https://deloitte.wsj.com/cmo/2018/06/12/building-reputation-resilience/

- Annual Crisis Report 2017 https://crisisconsultant.com/icm-annual-crisis-report/

- https://www.reutersevents.com/sustainability/business-strategy/essay-business-case-reputation-risk-management

- https://itif.org/publications/2018/07/23/when-does-environmental-regulation-stimulate-technological-innovation

- https://media.nesta.org.uk/documents/the_impact_of_regulation_on_innovation.pdf

- https://www.youtube.com/watch?v=iaaqmgw0GiU&feature=youtu.be&utm_source=We+Mean+Business&utm_campaign=eb5721b0df-December+2017_News_COPY_01&utm_medium=email&utm_term=0_07aa7946c8-eb5721b0df-277347689

- https://e360.yale.edu/features/economy_and_the_environment_the_case_for_environmental_rules

- https://www.corporateknights.com/channels/leadership/green-recovery-fever-spreads-around-globe-15916950/

- https://www.weforum.org/the-davos-manifesto

- About

- Journal

- Contact

- # Keep in touch

- support@aristotheme.com

- +90 530 737 2 444

- # Socials

- dribble

- youtube

- About

- Journal

- Contact

- External Link

- # Keep in touch

- support@aristotheme.com

- +90 530 737 2 444