Theiah insights

Resilience > Reduced Supply Chain Risk

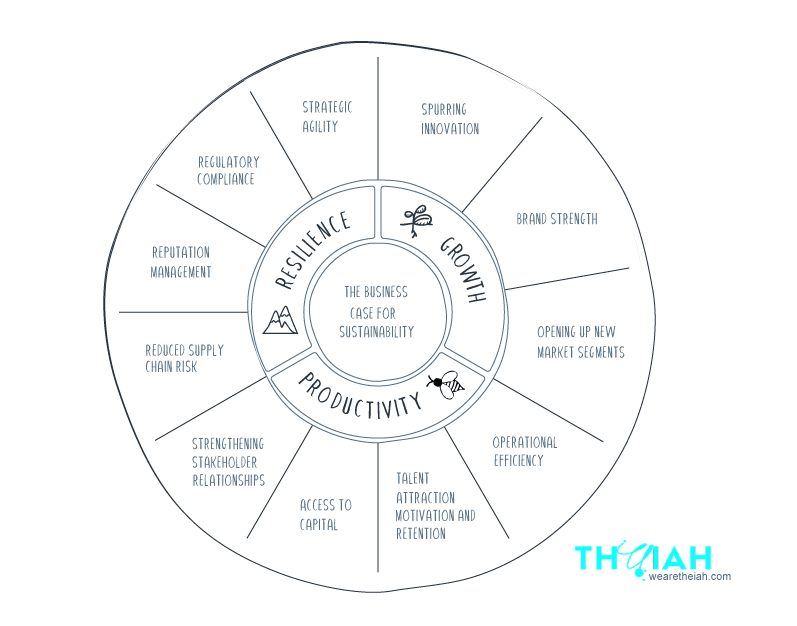

As economies and businesses begin to consider how to recover from the damage wrought by the recent pandemic, many are rethinking their business models, operations, and supply chains; realising the volatility of a fast-paced world requires more resilient and agile organisations. Keen to avoid another fight for survival, those leading the charge are particularly focusing on enhancing the sustainability and efficiency of their supply chains - aiming to avoid future risks that could threaten both cash flow and the future of their business.

“Far from perceiving sustainability as a costly inconvenience, supply chain leaders are using it to their advantage.”

Miguel Cossio - Senior Principal Analyst, Gartner

The risks aren’t always obvious: but the costs are VERY high and often unexpected

Though it’s easy to ignore risks that are ‘hidden’ through the supply chain, neglecting sustainability issues can have a substantial impact on a company’s business operations over the medium to longer-term, or suddenly jeopardize the survival of a firm altogether (tail-risks).

- Externalities (i.e. costs not directly paid for in the production process) can affect production processes through disruptions in the supply chain, litigation and unexpected costs. (5)

- The majority of environmental risk, especially for consumer companies, is embedded in supply chains. (7) For example, the emissions in a company’s supply chain are usually far greater than its operational emissions (5.5 times higher on average); the same is true for the associated impacts and risks regarding deforestation and water security. (13)

- The true cost of unpriced natural capital assets (such as climate, clean air, groundwater and biodiversity) can be huge. One report estimates the annual unpriced natural capital costs at $7.3tn representing 13% of global economic production. (1)

- These costs aren’t top of mind until something goes wrong; and then they wreak havoc. Firms usually leave ‘externalities’ unpriced unled forced by regulation, unpriced natural capital costs usually remain externalised until adverse events (for example droughts (2) or floods (3)) cause rapid internalization along supply chains through commodity price fluctuation or production disruption.

- McKinsey reports that the value at stake from sustainability concerns can be as high as 70% of earnings before interest, taxes, depreciation, and amortization. (21)

- An analysis of the World Economic Forum comes to similar conclusions and identifies water and food crises, extreme weather events as well as a failure of climate change mitigation and adaptation amongst the ten global risks of highest concern. (4)

- In the largest study on climate change data and corporations, 8,000 supplier companies (that sell to 75 multinationals) reported on their level of climate risk. Of the respondents, 72% said that climate change presents risks that could significantly impact their operations, revenue, or expenditures. (20)

- Unilever estimates that it loses some €300 million per year as worsening water scarcity and declining agricultural productivity lead to higher food costs. (7)

- Bunge, an agribusiness firm, reported a $56 million quarterly loss in its sugar and bioenergy segments due to drought in 2010. Flooding in 2011 in Thailand, harmed 160 companies in the textile industry and halted nearly a quarter of the country’s garment production, increasing global prices by 28%. (22)

- The risks to companies failing to respond to the climate challenge are starting to grow. Leading investors, such as the Norwegian pension fund, Norges Bank, with assets worth $260bn, now expects companies to show strategies for climate change risk mitigation and water management. It has divested from both timber and palm oil companies that don’t meet their standards. (17). By 2030, all financial institutions in New Zealand will be required to report on the climate risk of their clients, which includes risk embedded in their supply chains; so those without active policies will find it difficult to access funding. It is expected my other countries will follow suit. (18)

- Be prepared: simply measuring risks increases resilience, lowers volatility

- Companies that proactively embrace more sustainable operations could capture up to a 25% cost advantage over peers that take a wait-and-see approach if - or when- carbon-pricing schemes are implemented. (12). This would be compounded with firms that operate across multiple markets, as could be landed with carbon tax in multiple locations.

- Companies investing in carbon reductions achieved a 50% lower volatility of earnings over the past decade and 21% stronger dividends than their low-ranking peers. (15)

- Responsible policies prompt companies to recognise and account for these potential costs, decreasing risk through transparency.

- Leading firms who preemptively clean up their supply chains find lower volatility of cashflows, as the impact of negative effects can be avoided or mitigated. (14)

Sustainability activities, therefore, play an important role in a firm’s risk management strategy

“By integrating climate change risk management into strategic planning, responding to CDP and taking action towards emissions reductions, companies are simply demonstrating a long-term view of how to best manage the assets of shareholders,”

— CDP; a non-profit organisation working on behalf of 767 institutional investors with assets of $92tn, to motivate companies to disclose and reduce their impacts on the environment and natural resources,

Cleaning up supply chains could actually give performance gains

- McKinsey found that supply chains, particularly for consumer businesses, hold the biggest opportunities for breakthroughs in sustainability performance. (7)

- Corporations that are actively managing and planning for climate change secure an 18% higher return on investment (ROI) than companies that aren’t – and 67% higher than companies that refuse to disclose their emissions.

- In one study by CDP nearly all (95%) supply chain members said suppliers showing environmental leadership are more competitive over the long term, with only 5% stating that in their experience those suppliers are more costly. (11)

- A report from CDP found the majority of supply chain initiatives aimed at reducing energy usage and switching to clean energy in real estate through the supply chain paid themselves off and began to deliver positive ROI within 3 years. (15)

- Business leaders from companies that are taking significant steps to lower impacts are finding the resilience they are building into their businesses is now recognized by investors and reflected in their share prices.

- Those who are actively conscious of their environmental and social impact: 3-19% higher valuations than average performers. 11% for consumer goods, 12 for pharma, 19% for oil and gas, 3% for finance. (24)

- Certifications of sustainable practices can prompt productivity gains and improve net income: according to an independent study by COSA, Rainforest Alliance reported that certified cocoa farmers in Cote d’Ivoire, for example, produced 1,270 pounds of cocoa per hectare, compared with 736 pounds per hectare on non-certified farms. (25)

Follow the leaders; then become one

In 2020, basic harm reduction is table stakes, and there are plenty of examples to jump-start this for firms starting their journey to clean up supply chains. However, there is still a huge opportunity for firms looking to find a competitive advantage in sustainable supply chains.

- Hilton created the Procurement Leadership Group in 2015. With its mission to bring together procurement professionals across industries to explore and innovate leading approaches to supply-chain sustainability that create business value and positive social and environmental impact (23)

- Unilever uses a software tool, developed with the University of Aberdeen, to collect data on whether farmers in its supply chain are using sustainable practices. Unilever offers them the tool for free, with the aim of procuring 100 percent of its agricultural content from sustainable sources by 2020. (7)

- In Pakistan, PepsiCo trained more than 600 farmers in sustainable farming practices and reduced water usage by 30% while lowering PepsiCo’s business costs; the farmers’ incomes also increased 30%. (10)

- Companies like Mars, Unilever, and Nespresso have invested in Rainforest Alliance certification to help farmers deal with climate volatility, reduce land degradation, and increase resilience to drought and humidity—all of which ensure the long-term supply of their agricultural products. Applying sustainability standards from organizations such as Rainforest Alliance, Fair Trade, and UTZ Certified helps boost crop yields and capacity — a critical need for a global food company dependent on reliable access to commodities. (23)

- While table stakes are reducing wastage, responsible sourcing and transparent emission disclosure, incremental competitive advantages can still be found in switching to 100% renewable energy, regenerative resource and community impact, and digitisation to increase efficiency and oversight. (8)

- Transformational - and mostly unharnessed - opportunities still exist for companies willing to take leadership. Partnership business models are one particularly large, untapped opportunity; for example, Kellogg’s and Seven Brothers Brewery partnered to create a beer composed substantially of byproducts from the Kellogg’s production process. (9)

To transform your industry, look for ways to develop end-to-end supply chain coalitions, building closed-loop, circular economy practices, using machine learning and shared data for optimisation, repurposing waste, and investing in co-designing disruptive business models and production technologies. We have a few more of these up our sleeve ;-)

References:

- About

- Journal

- Contact

- # Keep in touch

- support@aristotheme.com

- +90 530 737 2 444

- # Socials

- dribble

- youtube

- About

- Journal

- Contact

- External Link

- # Keep in touch

- support@aristotheme.com

- +90 530 737 2 444