Theiah insights

Resilience > Reputation Management

Warren Buffett famously said;

“It takes 20 years to build a reputation and five minutes to ruin it.”

A baby bird with a belly full of plastic, an oil spill, bleeding orangutan fingers highlighting deforestation, a small boy sewing a football: in the age of social media, negative brand press and events are amplified, and reputations are damaged in seconds, sometimes irreparably.

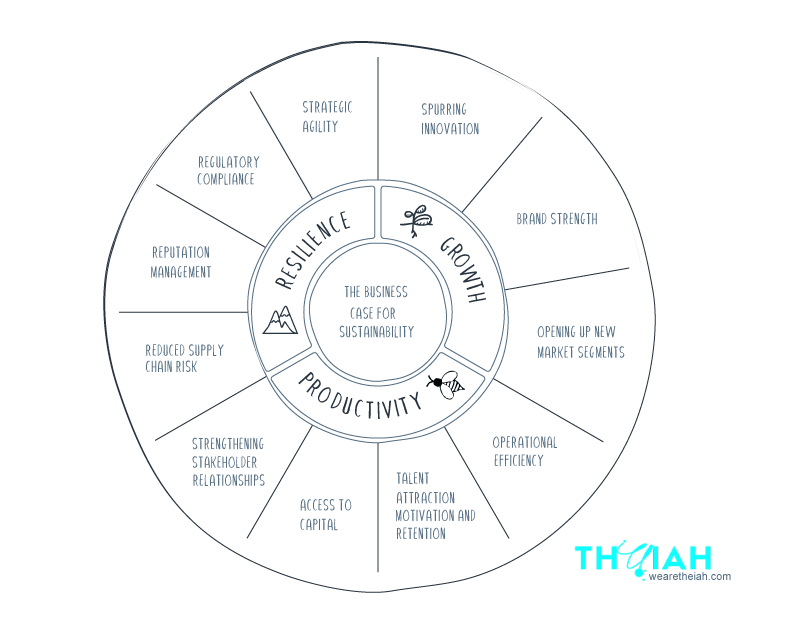

With transparency and monitoring increasing worldwide, it is only a matter of time before companies with irresponsible behaviour or questionable suppliers suffer reputational damage. On the other hand, those who place high importance on environmental and social impact find both reputations, and bottom lines, are more resilient in crisis. In this article, we’ll time into som key drivers, including:

- Increased brand equity, with stronger support from customers, communities and investors, leading to resilient purchasing power and access to finance.

- Reputation resiliency; when adverse events or global crises do happen, companies with stronger records of positive impact suffer less, and find reputations are more resilient

- Lower risk of environmental or ethical incidents in their own operations

- Lowered risk through ethical supply chains - even supplier incidents can have a catastrophic effect for associated companies (1)

- Proactive transparency and disclosure, garnering trust from investors (making it easier to for shareholders avoid risk) and other stakeholders, including customers and employees, and avoiding the risk of damage to reputation by damaging disclosures about unsustainable practices.

- However, transparency or disclosures without adequate sustainability and ethical procedures in places increases risk and damages reputation - commonly known as greenwashing (2)

And if you’re here for the gory case studies, including the KitKat campaign - they’re in the last section!

Increasing global scrutiny makes sustainability a priority

- As regulatory, societal, and shareholder pressures will likely force companies to disclose performance, most companies will eventually be “noticed. (7)

- “We will soon see shareholders and consumers having the same expectations [around ethical practices]” says Jerry O’Dwyer, principal at Deloitte Consulting “so [public and private] companies will naturally be subject to the same level of scrutiny.” (3)

- Studies show that industries with higher transparency expose companies to higher risk due to increased scrutiny - so it is extremely important to follow through on proper ethical and sustainability practices. It may be tempting to avoid disclosure, however, most supply chains are becoming more transparent independent of voluntary disclosures. (6)

- The message here is to be proactively transparent, but make sure you’re confident in what people will find. More sources of company evaluation mean more opportunities for scrutiny.

- One study recommends newer companies seeking to lower risk should start by building a strong foundation of sustainability practices, whereas established companies should act now to assess their direct and indirect risk. (7)

- Reputation-linked losses at public companies have increased by 301 percent over the past five years, according to a study by Steel City Re (8). In 2018 the number of incidents increased 25% percent over the previous year. (9)

- “Investors are demanding ecological transparency from companies, in an effort to minimise their exposure to the risk by supporting companies more likely to suffer reputation hits (21)

Get ahead of the pack: a reputation for positive impact drives resilience

- Consumer purchase intention is influenced 60% by the perception of the company, versus 40% perception about products. Studies show that 42% image of a company is stemmed from its CSR activities. That means up to 25% of purchase intention could be explained by a reputation for ethical practice. (23)

- Supporting research indicates brand reputation is a significant predictor of brand equity, and its predictive power boosts up in the presence of “CSR” activities. It was also found that CSR initiatives related to ethics, economy, and philanthropy dramatically speed up the conversion from brand reputation to real purchase intent related to brand equity. (22)

- A study from Accenture found “81% of CEOs believe that the sustainability reputation of their company is important in consumers’ purchasing decisions”. On the contrary, they found that only 33% of all surveyed CEOs think “that business is making sufficient efforts to address global sustainability challenges”. So there is still significant opportunities to be harnessed. (24)

- This purchasing power is resilient in global crises, like pandemics and recessions. Companies with stronger ESG reputations are more resilient with lower declines in profit and “experience no meaningful declines in share price compared to their industry peers during crises” versus firms with poor CSR reputations whose reputations declined by “2.4-3%; a market capitalization loss of $378M per firm.” (5)

- In line with this, a recent study tracked firms over a 15-year period, finding firms that adopt responsible social and environmental practices, relative to a carefully matched control group, have lower financial volatility, higher sales growth, and higher chances of survival. (11)

- Studies also show that pro-actively embracing ethical standards has a stronger positive effect. Research from Dr. Kossovsky, a practitioner in the reputation insurance field, concludes companies that have voluntarily embraced a sustainable business culture over many years “significantly outperform their counterparts over the long-term, both in terms of the stock market and accounting performance; reputational value restoration can yield a net additional average of 13.5% in market capitalization.” (15)

- Many firms are moving beyond compliance, to activities that produce a net-positive effect: Jerry O’Dwyer, principal at Deloitte Consulting: says many private companies are moving beyond being ethical to measuring and reporting their positive social impact on labour and human rights, in order to attract sustainable investment funds. (3)

- Firms that have a net positive effect on the environments or societies they operate in have their reputations safeguarded, even when mistakes are made. Recent research finds some harmful consequences of irresponsible behavior are alleviated by positive activities (4).

- According to the Reputation Institute — which monitors and ranks the reputation of 7,000 major organizations globally — intangible factors account for 81 percent of a public company’s market value, and improvement or deterioration in a company’s reputation has a tangible impact on performance.

- “Since 2006, a strong reputation yields 2.5 times better stock performance when compared to the overall market. And a 1-point increase in reputation yields a 2.6 percent increase in market cap,” the Institute said. It added, also claiming that when a reputation improves from ‘average’ to ‘excellent’ in rating, there’s a 2.7-times increase in purchase intent.

- Cutting corners increases risk: could you sustain a 7% drop in valuation?

- Research studies shows that without question.. environmental irresponsibility negatively affects corporate reputation. (4)

- Lee Glendon, head of research and advocacy at The Business Continuity Institute says many companies choose “lowest cost at any risk”, pointing out that making decisions based on short-term costs usually carries hidden risks. (3)

- In a recent global survey by Aon Risk Solutions, executives rank brand and reputation damage as the number one enterprise risk. Nearly three quarters (73 percent) of board members responding to a recent Deloitte survey say the reputational risk is the area in which they feel the most vulnerable, but only 39 percent say they have a plan to address a reputation crisis. (10)

- Reputation insurance research shows “reputational crisis will shave an average 7% from a company’s market capitalization.”(12)

The consequences can be catastrophic: Case Studies

- It has been more than two decades now since a 1996 issue of Life magazine depicted a Pakistani boy sewing a Nike soccer ball, reportedly for six cents per hour. After the story, the company lost more than half its market capitalisation in just one year – it took Nike six years of demonstrated social responsibility to recuperate. Even today Nike is – fairly or unfairly – ranked low on lists of ethical companies. It has survived financially, but the reputation of the brand may never recover. (14)

- H&M’s Greenwashing: Short-Sighted and Unethical: This was a recent headline from a leading branding publication blasting H&M for their practices, and attempts at a conscious clothing line and ‘circular’ practices aiming to make reparations. One example given is their clothes recycling bins. H&M makes it sound like the clothes dropped off into their recycling bins are made into new garments. However, according to environmentalist Elizabeth Cline, that’s likely to happen with less than 1% of the clothes collected: Globally, only 25% of the clothes going into recycling actually end up in sorting plants, according to The Economist. Of the clothes sent to H&M’s sorter of choice, I:Collect — the company that handles the donations for H&M — says that only 35% of what’s collected is recycled at all. (16)

- The company has also recently been targeted by press and consumers for claims of racist designs, and, along with Gap, claims of worker mistreatment, More than 540 workers at factories that supply the two retailers have described incidents of threats and abuse, according to two separate reports published last week by Global Labour Justice on gender-based violence in Gap and H&M’s garment supply chains. (17)

- It has been more than a decade since BP’s oil drilling rig Deepwater Horizon exploded and spilled oil into the Gulf of Mexico, killing 11 workers, injuring 17, and creating an environmental disaster. BP incurred significant costs from the 2010 disaster. In the two months after the spill, its share price dropped by 54%. The U.S. Environment Protection Agency banned BP from bidding on new federal contracts for two years. (18).

- In the 1990s, Nike was severely embarrassed when a US magazine featured a photograph of a young Pakistani boy sewing together a Nike football. The following year it was revealed that workers in one of its contracted factories in Vietnam were being exposed to toxic fumes at up to 177 times the Vietnamese legal limit. The company was accused of systematic, abusive labor practices, from low wages to sweatshops. The company’s reputation took a hit when it became the target for wide-spread negative press coverage and protests. In 1994 alone, well-respected publications including Rolling Stone, The Economist, The Boston Globe, and The New York Times released “sweatshop” reports, implicating Nike. Three years later, anti-Nike rallies were planned in 50 US cities and 11 other countries. By 1998, the company faced real financial consequences: falling stock prices and weak sales. Nike’s chairman and chief executive, Philip H. Knight finally acknowledged: “The Nike product has become synonymous with slave wages, forced overtime and arbitrary abuse. I truly believe that the American consumer does not want to buy products made in abusive conditions. The reputational damage lasts until this day, with many consumers associating Nike with negative ethical standards - possibly unfairly now, as the company now have stringent policies. (19)

- These cases are not limited to Western companies exploiting cheap labour in underdeveloped countries; simply shifting labour onshore won’t save companies. Boohoo, the umbrella fashion company whose corporate stable includes some of the largest brands in Europe, was recently the subject of a huge, damaging scandal when researchers found the company was paying workers in the Midlands in England as little as £4 an hour, less than half the minimum wage. (20)

- In 2010, Greenpeace launched a very public attack on KitKat, launching a parody ad of an office worker opens a KitKat wrapper, but instead of fingers of chocolate, he finds the finger of an orangutan – complete with tufts of orange hair. Coworkers watch in horror as he crunches into the finger and blood dribbles onto his keyboard. The video urged viewers to “give the orangutan a break” and “stop Nestlé buying palm oil from companies that destroy rainforests”.The attack surprised Nestlé. For one thing, the company thought it had already been addressing the issue. Nestlé had adopted a “no deforestation” policy when directly sourcing palm oil, committing that its palm oil would “not come from areas cleared of natural forest after November 2005”. Nestlé neither produced palm oil nor owned any farms near orangutan habitats, nor had it ever ordered the clearing of rainforests to increase the production of palm oil – but one of its suppliers had. They agreed to the demands of Greenpeace with 5 days. (3)

And to conclude…

This evidence is compelling and points in an important direction: reputation hits hurt companies, and reputation enhancing-work helps companies, financially and often substantially so (14).

Most of the value of a 21st-century firm comes from intangible assets, such as brand and corporate culture - a category traditionally difficult to measure. If a company improves working conditions, it’s difficult to estimate how much more productive workers will be and how much greater profit this increased productivity will translate into. The same is true for the reputational benefits of a superior environmental record.

A company that’s free from the shackles of having to justify every investment by a calculation will invest more and may ultimately become more profitable. When companies take this fact as seriously as direct cost or profit-making activity, they realise that deploying an effective sustainability strategy unlocks hidden value that otherwise lies dormant in the silos of the organisation.

References:

-

https://www.researchgate.net/publication/299467100_How_Does_Environmental_Irresponsibility_Impair_Corporate_Reputation_A_Multi-Method_Investigation

3)https://www.ft.com/content/56b594be-6d23-11e1-b6ff-00144feab49a

4)https://www.researchgate.net/publication/299467100_How_Does_Environmental_Irresponsibility_Impair_Corporate_Reputation_A_Multi-Method_Investigation -

Dr. Nir Kossovsky and Peter J. Gerken, CPCU, Steel City Re, “The Looming Reputation Risk Explosion: Massive Financial Impact Possible in 2018 from Corporate Reputational Crises,” December 2017

-

ICM Annual Crisis Report, April 2018

-

https://deloitte.wsj.com/cmo/2018/06/12/building-reputation-resilience

-

Economist Intelligence Unit. “A Crisis of Culture: Valuing Ethics and Knowledge in Financial Services”. 2013.

-

https://www.amazon.ca/Reputation-Stock-Price-You-Companies/dp/1430248904

-

https://www.brandingmag.com/2019/12/12/hms-greenwashing-short-sighted-and-unethical/

-

https://www.theguardian.com/global-development/2018/jun/05/female-garment-workers-gap-hm-south-asia

-

https://www.independent.co.uk/life-style/fashion/hm-hoodie-racist-boycott-advertising-people-h-m-a8149246.html

(20) https://www.theguardian.com/business/2020/jul/08/boohoo-fashion-factory-retailer-uk -

https://journals.sagepub.com/doi/full/10.1177/1847979020927547

-

. Esen, E . The influence of corporate social responsibility (CSR) activities on building corporate reputation. In: Alejandra Gonzalez-perez, M, Leonard, L (eds) International business, sustainability and corporate social responsibility, Vol. 11. Bingley: Emerald Group, pp. 133–150.

- About

- Journal

- Contact

- # Keep in touch

- support@aristotheme.com

- +90 530 737 2 444

- # Socials

- dribble

- youtube

- About

- Journal

- Contact

- External Link

- # Keep in touch

- support@aristotheme.com

- +90 530 737 2 444