Theiah insights

Productivity > Strengthening Stakeholder Relationships

Last year, the Business Roundtable (representing the CEOs of America’s largest and most powerful corporations) redefined the purpose of a corporation: to serve the needs of all stakeholders. This deliberate move away from profit maximisation was not out of altruism; better relationships with stakeholders ultimately presents a huge benefit to businesses and delivers greater long-term value for shareholders.

“Creating value for stakeholders isn’t just a worthy ideal – it’s good business sense.”

Alex Edmans, Professor of Finance at London Business School and Academic Director of the Centre for Corporate Governance.

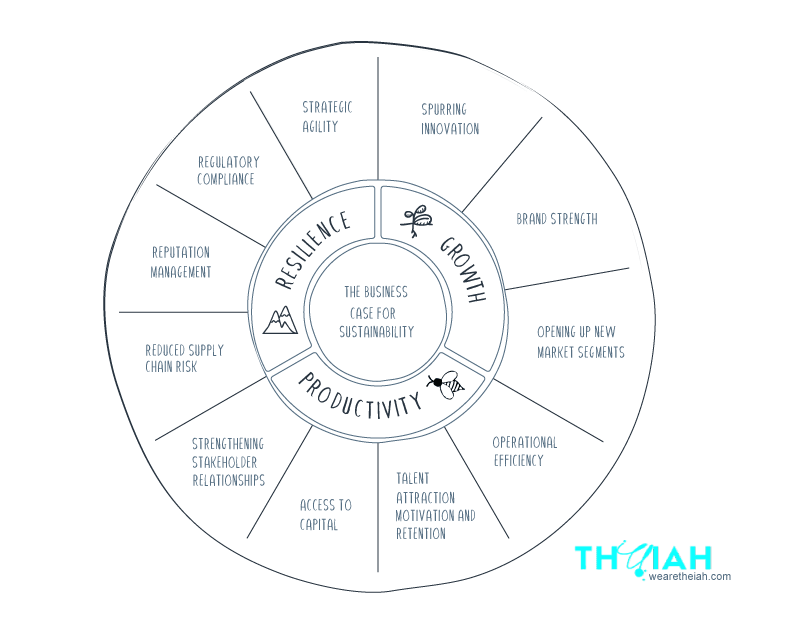

Theiah - Business Case for Sustainability: productivity driven by better relationship with stakeholders.

Stronger relationships with governments and communities can result in tax breaks and favourable regulation; stronger relationships with suppliers can result in lower costs and innovation through the supply chain; better customer relations can result in higher trust and loyalty while stronger employee relations result in reduced turnover and higher productivity. Lastly: sustainability can actually promote stronger shareholder relations, with a higher proportion of investors than ever looking toward this as an indicator of strong leadership.

We’ll break down each of these stakeholders and the value to businesses in the article.

Stronger relationships with regulators and communities

- Havard professors Michel Porter and Mark Kramer proved to create shared value,” (i.e beyond the business) can generate significant economic value, both for the firm, and wider communities, by identifying and addressing social problems that intersect with their business. (2)

- Companies with responsible practices tend to create positive externalities: these generate value beyond the firm for communities, economies, and ecologies and that is something regulators want to encourage.

- Princeton economists Harrison Hong and Inessa Liskovich studied how more socially responsible companies receive lower fines and more favourable concessions from regulators.

- “One implication of our analysis is that firms might very well have a strategic motive to be socially responsible as a form of insurance in case of unfavorable regulation,” the researchers conclude in the paper (3)

- A study of the gold mining industry, for example, found that stakeholder relations can heavily influence land permitting, taxation, and the regulatory environment, thus playing a substantial role in determining whether a firm has the right to transform gold into shareholder capital. The study authors write:

- Stakeholder engagement “is not just corporate social responsibility but enlightened self-interest.” (4)

- As the benefits to economies of more sustainable and socially responsible practices become clear, regulators in many countries are responding with tax-breaks and grants to support these shifts. In North America, there are a wide range of benefits, at the local, state and federal level. Examples include: Installing pollution control equipment, investing in energy-efficient buildings or components, manufacturing products from recycled materials, investing in systems to reuse waste, environmental remediation activities and using ‘green’ energy sources. (4)

- Structured collaboration with the community on key projects also enhances relationships and improves understanding of community issues and concerns. And improved coordination enhances impact and value at the community level and strengthens social license. (5)

Stronger relationships with suppliers

- When customers, suppliers, and other stakeholders see that a company has a strong higher purpose, they are more likely to trust it and more motivated to interact with it.(6)

- With financial suppliers, firms with good sustainability standards enjoy a significantly lower cost of capital. Superior ESG performers receive around 1.8% reduction in the cost of equity. (7).

- Research shows collaboration on sustainable practices improves supplier performance; and of course increased revenue and resilience from their customers bodes well, especially for dependent suppliers (8).

- Risks and adverse events due to unsustainable or irresponsible practices can undermine relationships, leading to increased conflict and reduced cooperation. This can disrupt a firm’s ability to operate on schedule and budget (9).

- One example is Stonyridge farms: the Vermont-based yogurt manufacturer, faced a strategic challenge — uncertainty in the supply of organic bananas — it solved it through transformational collaborations that have changed the face of how its suppliers go to market. To address this challenge, Stonyfield worked with the non-profit Sustainable Food Lab to develop small-scale fruit-processing operations. “We decided — in collaboration with the growers — to disrupt their business model by installing small-scale processing capability at the grower-association level,” explains Wood Turner, (then) vice president of sustainability innovation. “Growers are now not just responsible for bananas, but also for processing and selling them to the global marketplace.” The collaboration solved Stonyfield’s supply issue and gave the growers more independence and access to a wider market. (10)

Stronger relationships with employees

More than ever, employees, especially Millennials, want to work for organizations that can be trusted to contribute to a higher cause. Greater collaboration with employees is also typical of sustainable companies, leading to stronger cultures and higher productivity. (11)

- 70% of millenials said that they were more likely to choose to work at a company with a strong environmental agenda (12)

- 3/4 of America’s millennial workforce prioritizes sustainability over other factors that determine the attractiveness of a job. (12)

- In the current workforce, 1/10 would actually take a pay cut to work at a more sustainable company (12)

- 53% would work harder if they were making a difference to others.

- Companies with high employee satisfaction outperformed their peers by 2.3%-3.8% per year over a 28-year period. That’s 89%-184% compounded. (15)

- Improved sustainability standards can also reduce annual quit rates by 3-3.5% (14)

- This saves replacement costs - up to 90%-200% of an employee’s annual salary for each retained position.

- See our article on talent attraction, motivation and retention for more evidence on this

Stronger relationships with customers

- Data company Nielsen concludes ‘sustainability is a customer centric strategy’; firms committed to sustainability are paying greater attention to the demands of their customers, and are being rewarded with stronger relations ships, evidenced in higher loyalty, growth and sales. (17)

- According to the Edelman trust barometer, distrust of institutions is at all time high: sustainable practices drive greater transparency, which in turn increases the trust of consumers. (18)

- 1/3 of customers prefer to buy from sustainable brands (19)

- 73% of consumers are willing to change their buying habits to reduce their impact on the environment. (20)

- For nearly half of consumers, environmentally-friendly is more important than a brand name. (21)

- See our article on increased brand strength for more evidence on this.

Long term value for shareholders:

- Investors are increasingly recognising looking for responsible companies as an indicator of good leadership and long term value. (22)

- The 2020 EY Global Institutional Investor Survey shows 91% of investors say ESG is critical to decision making. (23)

- They’re realising companies pressured to deliver greater and greater profit margins to their financial owners in the space of a quarter, or less, might not be making the investments and strategic directional decisions that will allow them to thrive in the longer term. (24)

- For example: investors did not pour more than $280 billion into the renewable-energy sector last year out of the goodness of their hearts. Many have been investing aggressively to exploit immediate, profitable opportunities to address climate change.(25)

- Firms with effective sustainability prioritize transparency and disclosure. Increasing transparency and accountability builds trust with equity partners and minimizes risk perception through what the authors call “reduced informational asymmetry”.

- A study by BCG found 75% of investors look for firms who pay attention to their total societal impact, as they expect improved revenue and operational efficiency (27).

- See our article on access to capital for more on this.

Incorporating sustainable and socially responsible practices also promotes the need to continually talk with and learn from key stakeholders. It requires a greater awareness of systems. Through regular dialogue with stakeholders and continual iteration, a company with a sustainability agenda is better positioned to anticipate and react to economic, social, environmental, and regulatory changes as they arise.(1)

References:

-

https://www.areadevelopment.com/taxesIncentives/4-28-2009/sustainability-incentives.shtml?Page=2

-

https://hbr.org/2019/09/put-purpose-at-the-core-of-your-strategy

-

Chava, S. (2014). Environmental Externalities and Cost of Capital. Management Science, 60(9), 2223-2247

-

https://www.sciencedirect.com/science/article/abs/pii/S1478409218301523

-

https://hbr.org/2016/10/the-comprehensive-business-case-for-sustainability

-

https://hbr.org/2019/09/put-purpose-at-the-core-of-your-strategy

-

http://www.globaltolerance.com/thought-leadership/the-values-revolution/

-

www.london.edu/think/how-great-companies-deliver-both-purpose-and-profit

-

https://www.shrm.org/about/foundation/research/documents/retaining%20talent-%20final.pdf

-

https://www.nielsen.com/us/en/insights/article/2018/sustainability-is-a-consumer-centric-strategy/

-

https://www.nielsen.com/au/en/insights/article/2019/finding-success-through-sustainability-aus/

-

https://www.nielsen.com/au/en/insights/article/2019/finding-success-through-sustainability-aus

-

https://www.ey.com/en_bh/assurance/how-will-esg-performance-shape-your-future

-

https://www.fs-unep-centre.org/wp-content/uploads/2020/06/GTR_2020.pdf

-

https://www.iisd.org/publications/corporate-social-responsibility-implementation-guide-business

-

https://www.bcg.com/publications/2018/business-opportunity-solving-world-big-problems.asp

- About

- Journal

- Contact

- # Keep in touch

- support@aristotheme.com

- +90 530 737 2 444

- # Socials

- dribble

- youtube

- About

- Journal

- Contact

- External Link

- # Keep in touch

- support@aristotheme.com

- +90 530 737 2 444