Theiah insights

Productivity > Operational Efficiency

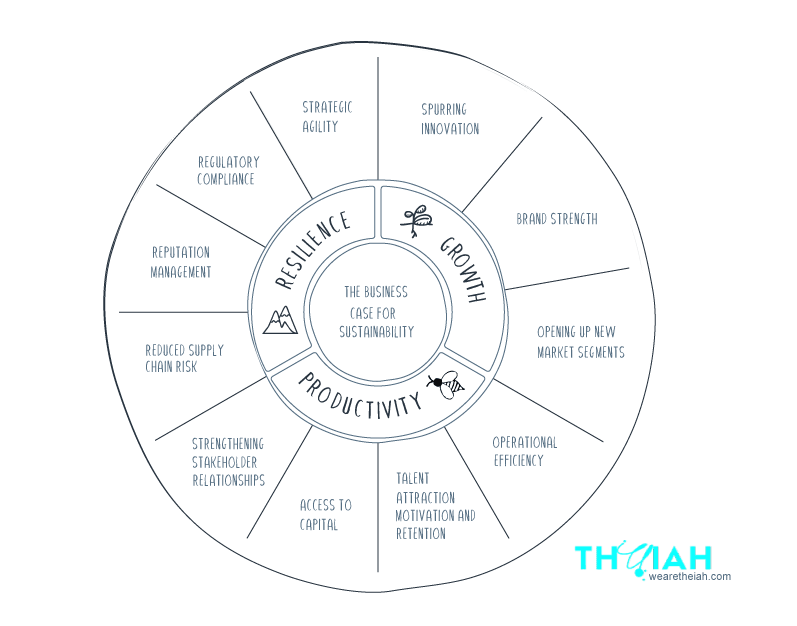

Perhaps the most clear-cut and quickly realised benefit of sustainability comes from operational efficiency. Honing in on opportunities for improvement here can drive enormous cost reductions.

Andrew Winston sums up the business case neatly in an MIT Sloan Management Review article (helpfully titled “Explaining the Business Case for Sustainability Again, and Again, and Again”) (1);

“Many initiatives under the banner of “sustainability” save money quickly — for example, projects that improve efficiency, save energy, or reduce waste.”

Michael Porter, the renowned Harvard Business School professor, has also been advocating the business case for sustainability since the 80’s. Aside from clear advantages to sustainable operations, Porter and Claas van der Linde argue that producing waste and inefficient use of natural resources is actually a sign of bad management. (2)

Drivers of higher operational performance

- Meta-studies show a positive correlation between sustainability and operational performance. Arabesque and the University of Oxford reviewed the academic literature on sustainability and corporate performance; 90% of studies show ESG standards lower cost of capital, and 88% of studies showed a positive correlation to operational performance. (4)

- Operational cost reductions commonly arise from greater natural resource efficiency (like water and energy), pollution management including carbon emissions, and minimising waste. (5-10)

- Clarkson et al. (2004) show that investments in pollution abatement technologies pay off, especially for firms that pollute less (9), while King and Lennox (2002) document that proper waste prevention leads to better financial performance as measured by Tobin’s Q and ROA.(8)

- More eco-efficient firms also have significantly better operational performance as measured by return on assets (ROA). (11)

Significant, often speedy ROI

- Investments in this area generally show a positive ROI: DOW have seen a nearly 500% return in improving resource efficiency over the last 24 years; investing $2 billion for savings of 9.8 billion. (4)

- One study estimated that companies experience an average internal rate of return of 27% to 80% on their low carbon investments. (12)

- Michael Porter and Claas van der Linde examined 181 ways of preventing waste generation found that only one of them “resulted in a net cost increase”. In other words, process innovation more than off-sets costs in 180 out of 181 or 99.5% of cases. (3)

- Another study found a 10% reduction in emissions resulted in a $34 million increase in market value. (13)

Competitive advantage and indicator of strength

- Multiple studies show more efficient use of natural resources allows companies to gain a competitive advantage when the economy is weak (2, 3, 14).

- Investors look at sustainability as a positive indicator: in a BCG study, 75% of investors said they expect improved revenue and operational efficiency when companies have strong environmental ratings. (15)

- A significant proportion of inefficiencies could come from outside the company, from the supply chain. Either fixing these or strategic sourcing with responsible supplies could result in direct cost reductions for the firm. (16)

- And finally, to end as we began: Michael Porter and Claas van der Linde make a very clear conclusion from their studies: “When scrap, harmful substances, or energy forms are discharged into the environment as pollution, it is a sign that resources have been used incompletely, inefficiently or ineffectively. It is a sign of bad management.” (2)

Case studies

- In the last 24 years, DOW invested nearly $2billion to improving their resource efficiency. Comparatively, they have saved $9.8 billion with a net profit of $7billion due to their reduced energy and wastewater consumption as a direct result of their investment.

- In 2013, GE had reduced greenhouse gas emissions by 32% and water use by 45% compared to 2004 and 2006 baselines, respectively, resulting in $300 million in savings.

- Wal-Mart, for example, aimed to double fleet efficiency between 2005 and 2015 through better routing, truck loading, driver training, and advanced technologies. By the end of 2014, they had improved fuel efficiency by approximately 87% compared to the 2005 baseline. In that year, these improvements resulted in 15,000 metric tons of CO2 emissions avoided and savings of nearly $11 million.

- Mars estimates that approximately 85 percent of its emissions are from the goods and services it purchases. In one initiative to combat this, the company partnered with nonprofit agencies that certify small-scale cocoa famers around the world. These agencies ensure that farmers get healthy crop yields and receive a premium price on their cocoa. And they ensure that human rights are upheld and the environment is protected. These partnerships are good for smallholder farming communities, good for the environment—and good for Mars, which has mitigated a key risk in its supply chain. The company’s goal: a cocoa supply that is 100% certified by 2020. Yep - that’s this year. We’ll do a deeper dive into this later to see how they’re going.

- Natura began an initiative to account for environmental costs in supply chains: “Strategic Sourcing Triple Bottom Line”, where it works with its suppliers to put a price on externalities like carbon dioxide emissions, water use, and waste generation. This “shadow price” for each environmental impact helps Natura to select suppliers based on both pricing and environmental impact. This approach is improving the economic, social, and environmental performance of its supply chain while also saving the company money. Natura estimates that the net benefit of this program will be BRL$1.9 million (more than US$960,000) over the next four years.

From (16) and (17)

References:

-

Porter, M. E., & van der Linde, C. (1995a). Green and Competitive. Harvard Business Review (September-October), 120-134.

-

Porter, M. E., & van der Linde, C. (1995b). Toward a New Conception of the Environment-Competitiveness Relationship. Journal of Economic Perspectives,

-

http://www.arabesque.com/docs/sray/From_the_stockholder_to_the_stakeholder.pdf

-

Fogler, H. R., & Nutt, F. (1975). A Note on Social Responsibility and Stock Valuation. Academy of Management Journal, 18(1), 155-160.

-

Spicer, B. H. (1978). Investors, Corporate Social Performance and Information Disclosure: An Empirical Study. The Accounting Review, 53(1), 94-111.

-

Hart, S. L., & Ahuja, G. (1996). Does it Pay to be Green? An Empirical Examination of the Relationship between Emission Reduction and Firm Performance. Business Strategy and the Environment, 5, 30-37

-

King, A., & Lennox, M. (2001). Does It Really Pay to Be Green? An Empirical Study of Firm Environmental and Financial Performance. Journal of Industrial Ecology, 5(1), 105-116.

-

Clarkson, Li, and Richardson (2004). Clarkson, P. M., Li, Y., & Richardson, G. D. (2004). The Market Valuation of Environmental Capital Expenditures by Pulp and Paper Companies. The Accounting Review, 79(2), 329-353

-

Darnall, N., Henriques, I., & Sadorsky, P. (2008). Do Environmental Management Systems Improve Business Performance in an International Setting? Journal of International Management, 14, 364-376.

-

Guenster, N., Derwall, J., Bauer, R., & Koedijk, K. (2011). The Economic Value of Corporate Eco-Efficiency. European Financial Management, 17(4), 679-704.

-

http://www.wemeanbusinesscoalition.org/sites/default/files/The%20Climate%20Has%20Changed_2.pdf

-

https://www.researchgate.net/publication/24095695_Does_The_Market_Value_Environmental_Performance

-

https://www.greif.com/uploads/media/default/0001/03/5eb8dc59cbe33c20cbd3b459eb39b2ff595e3f6f.pdf

-

https://www.bcg.com/publications/2018/business-opportunity-solving-world-big-problems.aspx

-

http://pdf.wri.org/aligning_profit_and_environmental_sustainability_stories_from_industry.pdf

-

https://hbr.org/2016/10/the-comprehensive-business-case-for-sustainability

- About

- Journal

- Contact

- # Keep in touch

- support@aristotheme.com

- +90 530 737 2 444

- # Socials

- dribble

- youtube

- About

- Journal

- Contact

- External Link

- # Keep in touch

- support@aristotheme.com

- +90 530 737 2 444